Changing the way we manage our money is the result of innovative collaborations between traditional banks and financial technology (FinTech) companies in the ever-evolving digital finance landscape. # Cash App with Lincoln Savings Bank

Lincoln Savings Bank has become one such prominent partnership that has gained prominence. By bridging the gap between traditional banking and mobile payment apps, these strategic alliances promise users enhanced financial services.

The purpose of this blog is to explore how a partnership between Cash App and Lincoln Savings Bank benefits users and shapes the future of digital banking.

Lincoln Savings Bank and Cash App

With the partnership between Lincoln Savings Bank and Cash App, two distinct entities are combined to provide Cash App users with a seamless experience.

Through this collaboration, Cash App users gain access to a virtual bank account integrated with their Cash App account, where Lincoln Savings Bank facilitates transactions between the virtual bank account and Cash App account.

With this partnership, Cash App users, including you, will be able to receive direct deposits into their Cash App accounts.

The routing number associated with Lincoln Savings Bank is provided to you when you enable direct deposits on your Cash App.

With this routing number, you can transfer funds directly into your Cash App balance, such as your paycheck.

Cash App with Lincoln Savings Bank Partnership

It is often referred to as a payment service that enables seamless money transfers and banking transactions. You’re sure you don’t understand how Cash App works, aren’t you?

The platform’s banking services are powered by its banking partners, allowing it to provide convenient banking services through its mobile app.

The majority of the app’s banking features are powered by Sutton Bank and Lincoln Savings Bank.

Lincoln Savings Bank powers direct deposits through Cash App, while Sutton Bank powers the prepaid card and related features. Since the purpose of this article is to discuss Lincoln Savings Bank, we will focus mainly on it.

The Lincoln Savings bank offers a virtual bank account on the platform once you set up a Cash App Account. This Lincoln Savings bank simplifies transfers to and from your account.

How to Link Lincoln Savings Bank To Cash App Without Username And Password

Lincoln Savings Bank may not appear on the list of available bank accounts when you try to link your bank account to Cash App via the username and password. # Link Lincoln Savings Bank To Cash App

You can link it manually instead.

You can manually link your Lincoln Savings Bank account by entering your routing and account numbers, and then wait for Cash App to verify your account within 1-3 business days.

Cash App can be linked to Lincoln Savings Bank accounts without a username and password by following these steps:

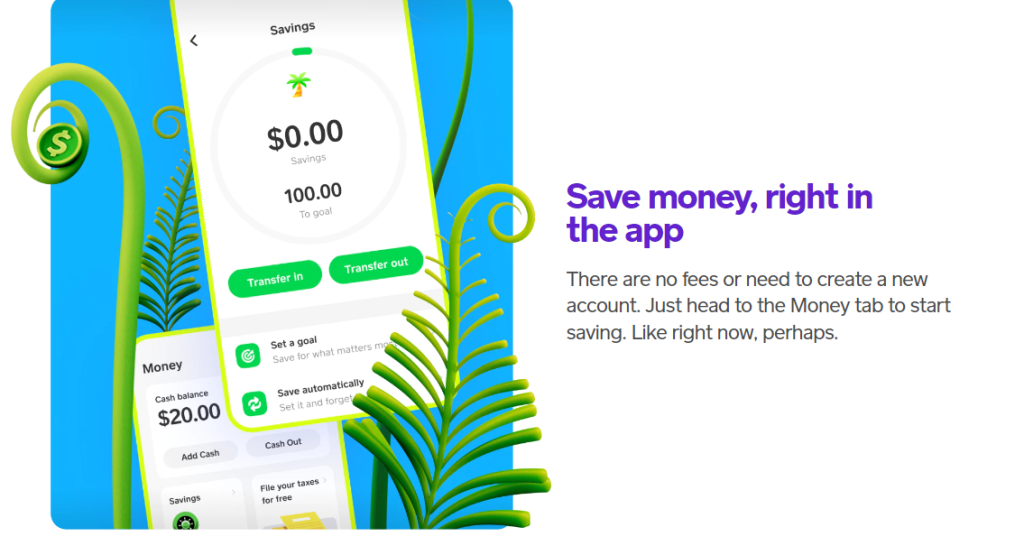

On the home screen of Cash App, tap the money tab.

- Select the amount you want to cash out and then click “Cash Out.”.

- “Standard (1-3 business days)” is the best choice.

- Search for “Cashapp” in the search box.

- To add manually, click “Add Manually”.

- Please enter the routing and account numbers for Lincoln Savings Bank.

Lincoln Savings Bank Cash App Username And Password

Cash App offers most banking services through Lincoln Savings Bank, as most of us now know.

Having this in mind, you might think that you have a username and password associated with your Cash App account that connects to Lincoln Savings Bank and gives you access to your bank account.

Lincoln Savings Bank username and password are required to link Cash App to Lincoln Savings Bank:

>> Adding Your Bank Account:

- On the home screen of Cash App, tap the profile icon.

- “Linked Banks” should be selected.

- Simply tap the “Link” button.

- Lincoln Savings Bank is one of the available banks to choose from.

- Using Plaid’s secure portal, you can access your Lincoln Savings Bank account.

You should know that Cash App usernames and passwords cannot be used to log in to Lincoln Savings Bank. # Lincoln Savings Bank Cash App Username And Password

>> Verifying Your Bank Account:

In order to ensure that your account is secure and that you are the legal owner, you will receive a prompt once you have added your bank account to complete the process.

This guide will walk you through the steps of verifying your Lincoln Savings Bank account using Cash App:

- Get the Cash App for your mobile device and open it.

- You will find a tab called “Banking” at the bottom of your screen.

- You will now be able to select your Lincoln Savings Bank account from the list of linked accounts.

- You can verify your bank account automatically by tapping the “Verify Account” option and following the prompts.

During the verification process, Cash App may ask for additional information about you, such as your name, date of birth, and phone number.

There have been reports from some users that Lincoln Savings Bank is not listed when they try to link a new bank account to their Cash App. # Lincoln Savings Bank Cash App Username And Password

Can I login to Lincoln Savings Bank with Cash App?

Lincoln Savings Bank can be accessed with Cash App. Cash App is a mobile payment service for sending and receiving money, buying and selling Bitcoin, and more.

Lincoln Savings Bank is a trusted financial institution that offers its customers a variety of financial services. # login to Lincoln Savings Bank with Cash App

You can access your Lincoln Savings Bank account balance from your mobile device, make transfers, pay bills, and perform other banking transactions conveniently by linking your Lincoln Savings Bank account to Cash App.

The following steps will guide you through logging into Lincoln Savings Bank with Cash App:

- Cash App can be downloaded for free from the App Store (for iPhone owners) or Google Play Store (for Android users).

- Your device needs to be open in order to access the Cash App.

- Fill out the Cash App registration form, or log in with your existing Cash App credentials.

- Select the “Banking” menu option and then select “Add Bank.” Search for Lincoln Savings Bank from the list of available banks.

- Enter the correct account number and routing number for your Lincoln Savings Bank account.

- Wait for a Cash App verification request. This process may take a few minutes or even several days.

- Follow the instructions from Cash App to link your Lincoln Savings Bank account. You will receive a notification once your account is linked.

- From your mobile device, you can view your account balance, transfer money, pay bills, and perform other banking transactions.

What Bank Is Cash App?

By partnering with Lincoln Savings and Sutton Bank, Cash App offers a variety of financial services to its users. Lincoln Savings and Sutton Bank are two reputable financial institutions.

With Cash App, you can access a checking-style account that comes with some extra perks. Cash App works with Lincoln Savings Bank to provide banking services to users.

By creating your own debit card, receiving your paycheck up to two days early, getting instant discounts while shopping at your favorite stores and investing your spare change with an automatic round-up savings program, you can, for example, get paid up to two days early.

If you wish to add Cash App as a bank through Plaid, you will need to manually enter your banking information. Cash App will not appear in the list of financial institutions automatically supported by Plaid.

Recover My Lincoln Savings Bank Cash App Username and Password?

The following steps will guide you through the process of resetting your password online:

1. Visit Lincoln Savings Bank’s Cash App login page.

2. Click on the “Forgot your password? ” link.

3. Enter your username or email address.

4. Click the “Submit” button.

5. An email with instructions on how to reset your password will be sent to you.

For instructions on how to reset your password, please refer to the email you received.

Conclusion

Through the partnership between Cash App and Lincoln Savings Bank, digital finance has progressed significantly. It combines the convenience, user-friendliness, and security of Cash App with the stability and security of traditional banking.

By partnering with this company, users will have access to seamless, secure financial transactions as well as savings accounts and direct deposits.

Combined with the evolution of financial technology, partnerships like this will become more common, offering users a broader selection of financial products and services.